capital gains tax changes 2021 uk

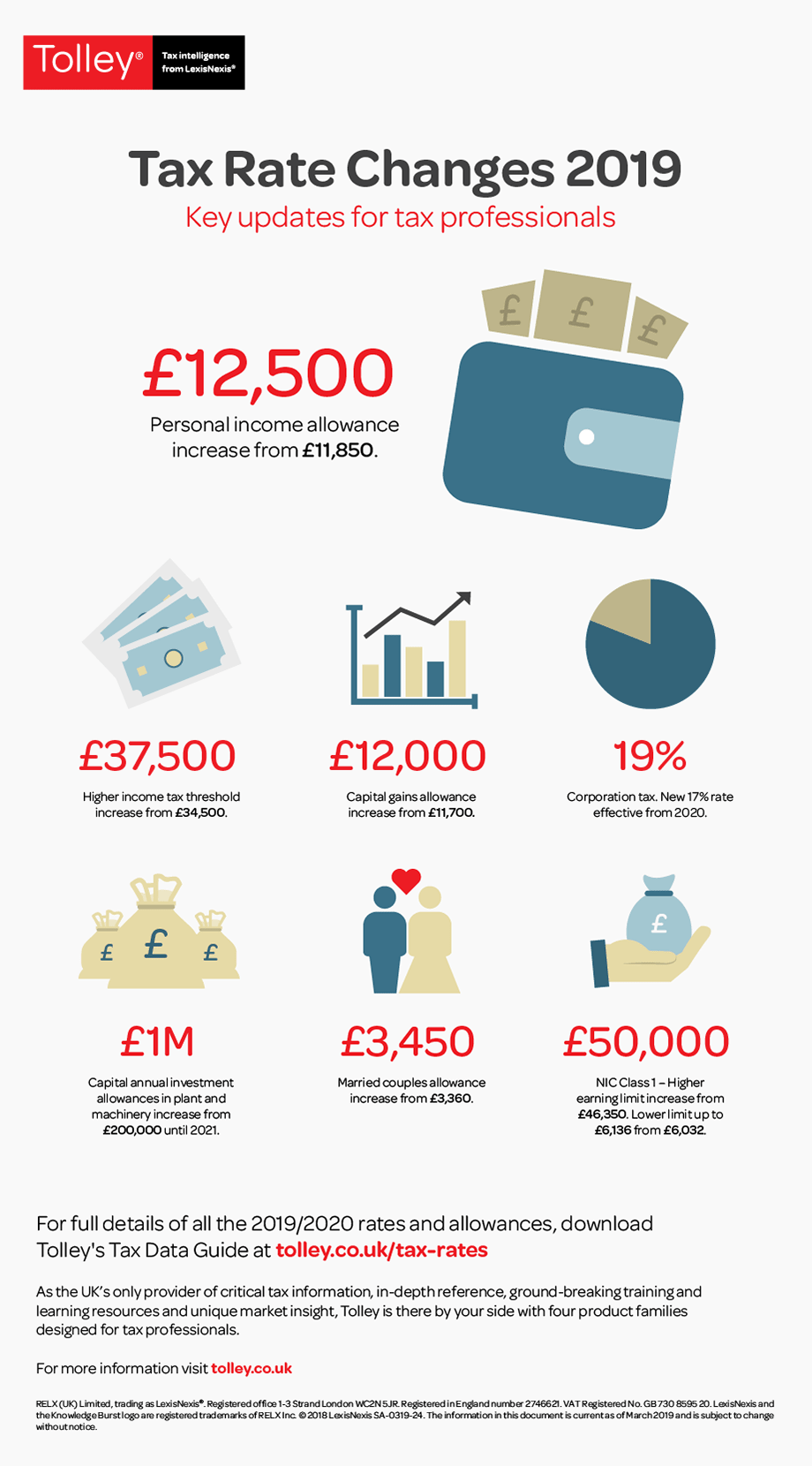

3 days ago First deduct the Capital Gains tax-free allowance from your taxable gain. For the 2021 to 2022 tax year the allowance is 12300.

From 6 April 2020 the annual exempt amount of capital gains tax for individuals and personal representatives increased from 12000 to 12300.

. Proposed changes to Capital Gains Tax. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Any gain over that amount is taxed at what.

For the 2021 to 2022 tax year the allowance is. This time last year an. Proposed changes to Capital Gains Tax.

With equivalent bodies providing state-funded housing. Capital Gains Tax UK changes are coming. It is now considered that the changes which could potentially include more.

Each year at the moment there is a personal capital gains tax allowance. The changes in tax rates could be as follows. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

2020 to 2021 2019 to 2020 2018 to 2019. The change will have effect on and after 6 April 2021. If you own a property with a.

What is the current capital gains tax rate. Add this to your taxable. What you pay it on rates and allowances 1 week ago First deduct the Capital Gains tax-free allowance from your taxable gain.

The maximum UK tax rate for capital gains on property is currently 28. What you pay it on rates and. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget.

118 Capital Gains Tax. Attend your first virtual pin meeting for FREE using the code YouTube just click on the link belowhttpspropertyinvestorsnetworkcoukmeetingsIn this. Ad If you have a 500000 portfolio get this must-read guide by Fisher.

Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020.

This could result in a significant increase in CGT rates if this recommendation is implemented. For trustees of settlements the annual. CGT is a complex tax and this is one of the reasons it is seen as a good candidate for sweeping reforms.

Its the gain you make thats taxed not the. You can change your cookie settings at any time. So for the first 12300 of capital gain you could take that money completely tax-free.

First deduct the Capital Gains tax-free allowance from your taxable gain. Non-resident Capital Gains Tax on the disposal of a UK residential property. For example if you started to receive taxable income during the tax year 202122 you will need to register with HMRC for tax return by 5 October 2022.

If you make a gain after selling a property youll pay 18. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. For example CGT is applied at a higher rate for property than other.

Relief for gifts of business assets. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. The same change will also apply for non-UK residents disposing of property.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

Budget 2021 Highlights And Key Changes Evelyn Partners

Five Capital Gains Tax Changes You Need To Know About Which News

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Capital Gains Tax Definition Taxedu Tax Foundation

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

The Complete Guide To The Uk Tax System Expatica

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Will Capital Gains Tax Increase At Budget 2021 What The Property Tax Rate Is And How It Could Change Today

Understanding The Tax Implications Of Stock Trading Ally

Changes To Uk Tax In 2022 Holborn Assets

Corporation Tax Income Forecast Uk 2021 Statista

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

United Kingdom Corporation Tax Wikipedia

Cgt Reform All Eyes On Cgt Reform In March 2021 Uk Budget

Capital Gains Tax Changes In 2021 Budget To Come Into Force Personal Finance Finance Express Co Uk

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century